Providing screenshots also helps us in resolving this topic. I tried changing the payments from UF to Checking and was going to fix it that way but that just created a credit balance in UF. If I make a JE to UF to offset, that JE shows up in the To Be Deposited window. I have about 6 items sitting there when I go to make a deposit. These are old problems from the past that I just want to get rid of.

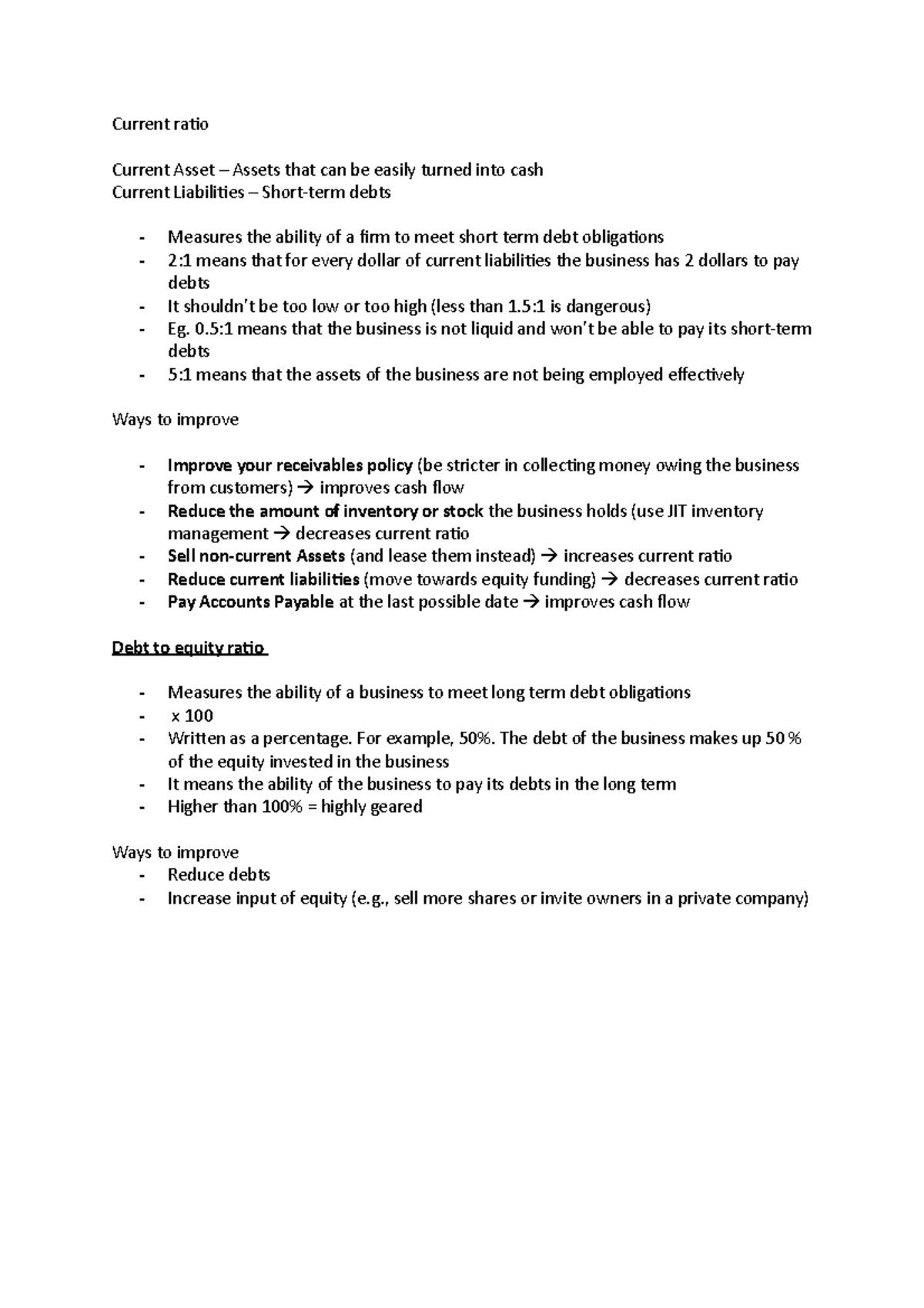

Take your time to review the form and double-check that all the information is accurate before moving on to the next step. Making any necessary adjustments at this stage will help avoid complications and errors during reconciliation. Start by navigating to the undeposited funds account in QuickBooks Online. This account can typically be found in your Chart of Accounts or in the Banking lease definition common types of leases examples section of your QuickBooks Online account.

Apple M1 Chip vs Intel: The Two Powerful Processors Compared

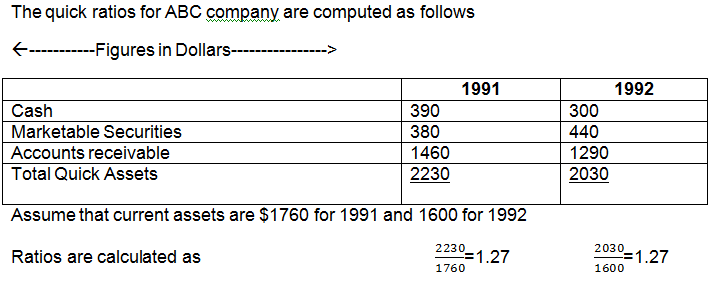

To address the issue of the $50 item appearing in Payments to Deposit and causing duplication, I recommend deleting the duplicate one. If this has already been reconciled, you can perform a special reconciliation to address the issue afterward. Based on the information you’ve shared, it appears that there’s a bank deposit that was created in the past but wasn’t made from Undeposited Funds. There was an undeposited $50 when I started working with a company. I recorded a negative entry in Journal Entries and then made the $0 deposit.

Introduction to X-Torrent: The Future of P2P File Sharing

Afterward, you can deposit the payments into the appropriate accounts to zero out the balance in your UF account. Before doing so, I recommend reviewing your bank statements to confirm they align with your records in QuickBooks. Furthermore, you can also directly create a bank deposit and select all the undeposited funds transactions to transfer them to a designated account. After I changed the undeposited to bank account, then went to reconcile, those payments are listed in the bank reconciliation. I have six entries in my undeposited list that needs to be cleared that are 2 years old. When you delete a reconciled deposit, it’ll cause a great impact on your account.

Clearing undeposited funds in QuickBooks Online is a vital task to ensure the accuracy and integrity of your financial records. Review the list to confirm that the payments you selected for the bank deposit no longer appear in the undeposited funds account. This indicates that the payments have been effectively moved to the bank account and are no longer part of the undeposited funds balance. To select a payment, check the box next to it in the bank deposit form. You can choose one or multiple payments to include in the deposit. When you receive a payment from a customer, QuickBooks Online automatically assigns it to the undeposited funds account instead of directly depositing it into your bank account.

Step 3: Create a new Bank Deposit

- Review the transaction details carefully to ensure their accuracy.

- This is the convenience of this special account I know you’ll learn to love.

- Regularly clearing undeposited funds in QuickBooks Online will contribute to efficient and streamlined bookkeeping, saving you time and effort in the long run.

You can open the original deposits that these transactions were supposed to go to and add the payments and trash can the manual line item to the sales/income acct. All of the dollars, etc have been deposited in the appropriate bank accounts, and everything is reconciled. Remember, it’s essential to regularly review, organize, and reconcile your financial records to ensure their accuracy and integrity. If you encounter any discrepancies or have specific questions, consult with a professional accountant or refer to the QuickBooks Online resources for further guidance.

You can create a Journal Entry, debit the Undeposited Funds account, and credit the designated account. You should seek guidance from your accountant to determine which account to create or use. However, the “Deposit To” option is not available in the “Customer Payment” windows for the undeposited funds I need to clear up (see attached). You can also change the account from Undeposited Funds to a different one in case you don’t want to delete the transaction completely. Just click the drop-down list for Deposit To and select the account that you want.

We will explain the concept of undeposited funds and why it is important to clear them. We’ll also provide you with a step-by-step process to help you confidently clear undeposited funds in your QuickBooks Online account. All of my undeposited funds are already in a deposit and cleared through the bank and reconciled already. I’ve got $86,500 worth of these undeposited funds for some reason and they’ve all cleared the bank. If they hadn’t, I would see them when I go to make deposits and I don’t. I’m sure they weren’t entered properly or something but I’m just not sure why they’re still there or what to do.